SEC Whistleblower Law Firm’s FAQs About SEC Whistleblower Program

Based on our experience successfully representing SEC whistleblowers, this FAQ provides an overview of key aspects of the SEC Whistleblower Program. Every case is unique. Contact us today to consult with our effective SEC whistleblower lawyers to find out if you may qualify for an SEC whistleblower award.

- What is the SEC Whistleblower Program?

- What are the largest SEC whistleblower awards?

- What violations qualify for an SEC whistleblower award?

- Can Zuckerman Law represent me if I do not live in the state/country where the law firm has an office?

- Why should I choose the Zuckerman Law to represent me in my SEC whistleblower claim?

- Can I submit an anonymous tip to the SEC Whistleblower Office?

- When is the best time to report the fraud or misconduct to the SEC?

- Can I submit an SEC Whistleblower claim if the SEC already has an open investigation into the matter?

- Who is an “eligible” SEC whistleblower?

- Can compliance personnel, auditors, officers or directors qualify for an SEC whistleblower award?

- What is “original information”?

- How might my information “lead to” a successful SEC enforcement action?

- Can I submit a claim if I was involved in the fraud or misconduct?

- Do I have to report a securities law violations to my company before reporting the violation to the SEC?

- Can I submit a tip if I agreed to a confidentiality provision in an employment/severance agreement?

- What factors does the SEC consider when determining the amount of the award?

- What employment protections are available for SEC whistleblowers?

- What type of evidence should I submit to the SEC?

- What happens after I submit a tip to the SEC?

- How long does it take to receive an award?

Experienced SEC Whistleblower Attorneys

The experienced whistleblower lawyers at Zuckerman Law represent whistleblowers worldwide before the SEC under the Dodd-Frank SEC Whistleblower Program. The firm has a licensed Certified Public Accountant and Certified Fraud Examiner on staff to enhance its ability to investigate and disclose complex financial fraud to the SEC, and two of the firm’s attorneys served on the Department of Labor’s Whistleblower Protection Advisory Committee and in senior leadership positions at a government agency that protects whistleblowers.

If you have original information that you would like to report to the SEC Whistleblower Office, contact the Director of our SEC whistleblower practice at [email protected] or call our leading SEC whistleblower lawyers at (202) 930-5901 or (202) 262-8959. All inquiries are confidential. The law firm’s SEC whistleblower attorneys will work to quickly provide SEC whistleblowers with the highest-quality representation. In conjunction with our courageous clients, we have helped the SEC halt multi-million dollar investment schemes, expose violations at large publicly traded companies, and return funds to defrauded investors.

Firm Principal Jason Zuckerman has been named by Washingtonian Magazine as a “Top Whistleblower Lawyer” and the firm has been ranked by U.S. News as a Tier 1 Firm in Labor & Employment Litigation.

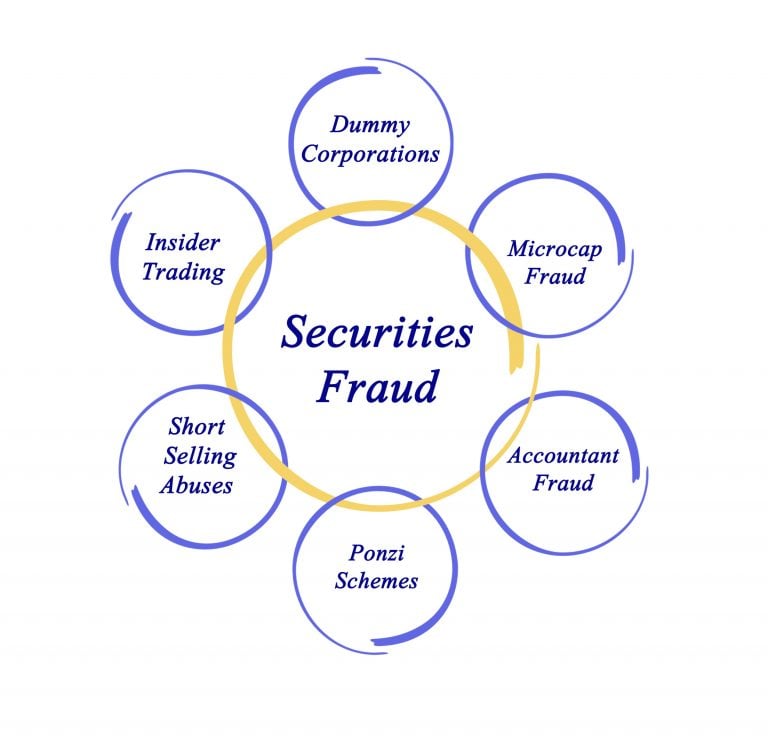

Leading whistleblower law firm Zuckerman Law has substantial experience investigating securities fraud schemes and preparing effective submissions to the SEC concerning a wide range of federal securities violations, including:

- Accounting fraud;

- Investment and securities fraud;

- EB-5 investment fraud;

- Manipulation of a security’s price or volume;

- Fraudulent securities offerings and Ponzi schemes;

- Unregistered securities offerings;

- Investment adviser fraud;

- False or misleading statements about a company or investment;

- Inadequate internal controls; and

- Violations of auditor independence rules.

SEC Whistleblower Rewards and Bounties

Qualifying for an SEC Whistleblower Award

For more information about the SEC Whistleblower Program, download our free ebook SEC Whistleblower Program: Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower Award and see the following resources:

- Tips for SEC Whistleblowers

- Leading SEC Whistleblower Law Firm Featured in Article About Growing Wave of Whistleblower Lawsuits

- SEC Whistleblower Reward Program FAQ

- Auditors’ and accountants’ guide to SEC whistleblower awards

- Whistleblower Protections and Incentives for Auditors and Accountants

- How to Report EB-5 Fraud and Earn an SEC Whistleblower Award

- CFTC Strengthens Anti-Retaliation Protections for Whistleblowers and Improves CFTC Whistleblower Award Program

- SEC Cracking Down on Ponzi Schemes

- SEC Scrutinizes “Fake News” Stock Promotion Schemes

- SEC Whistleblower Program: Exposing Insider Trading

- SEC Awards for Disclosures of Foreign Bribery or FCPA Violations

- Whistleblower Rewards and Bounties for Disclosures of Market Manipulation Schemes

- SEC Targeting Investment Adviser Fraud

- Compliance Personnel, Auditors, Officers and Directors Can Obtain SEC Whistleblower Awards

- Money Laundering and the SEC Whistleblower Program

- International Whistleblower Representation – SEC Whistleblower Attorney

- Anonymous Whistleblowing: Does the SEC Whistleblower Program Protect a Whistleblower’s Identity?

- SEC Awards for Disclosures of Foreign Bribery or FCPA Violations

- Securities Fraud Enforcement Action Prompts the Question: What Was the Company Smoking?

- Compliance Officer Whistleblower Representation

- SEC Whistleblower Program: What is the SEC Form TCR?

- Tale of Two Whistleblowers: Lessons Learned from Today’s SEC Whistleblower Award

- Whistleblowers Help CFTC Obtain Record Penalties for Commodities Fraud

- Report Underscores Importance of Whistleblower Rewards and Protections for Internal Auditors

- SEC Sanctions: Whistleblower Reference Guide

- Protections and Rewards for Cybersecurity Whistleblowers

- CFTC Announces Second Whistleblower Award in 2016 as the Agency’s Whistleblower Reward Program Picks Up Steam

- EB-5 Visa Scandal Underscores the Critical Role Whistleblowers Play in Exposing EB-5 Fraud

- SEC Enforcement Director Touts Success of SEC Whistleblower Program

- SEC Whistleblower Program Not Limited to Corporate Insiders

- SEC Pays $3M Award to Whistleblower

- SEC Draft Strategic Plan Affirms the Importance of the SEC’s Whistleblower Reward Program

- Whistleblower Lawyer Interviewed About SEC Whistleblower Award

- Wall Street Journal Quotes Jason Zuckerman on Dodd-Frank SEC Regulations

- SEC Whistleblower Lawyer Quoted in National Law Journal About SEC Whistleblower Program

- SEC Whistleblower Lawyer Zuckerman Quoted About SEC Whistleblower Award for Independent Analysis

- SEC Whistleblower Lawyer Jason Zuckerman Quoted About Tips for SEC Whistleblowers

- Whistleblower Lawyer Jason Zuckerman Quoted About SEC Whistleblower Award

- Whistleblower Lawyer Interviewed About the Rise of Cybersecurity Whistleblowing

- Whistleblower Attorney Zuckerman Quoted in Washington Post About SEC Order

- Whistleblower Attorney Dallas Hammer Interviewed by Bloomberg About Dodd-Frank Protected Whistleblowing

- SEC Whistleblower Lawyer Zuckerman Quoted About SEC Whistleblower Award for Independent Analysis

- Audit committees need to dig into personal relationships

- Whistleblower Bounties Pose Challenges

- CFO Magazine Quotes Whistleblower Attorney Jason Zuckerman About Dodd-Frank Whistleblower Rules

- Fiscal Times Quotes Jason Zuckerman About Dodd-Frank Act Whistleblower Reward Provisions

- Whistleblower Attorney Jason Zuckerman Quoted About Battle Over Corporate Whistleblower Rules