Tax Fraud Whistleblower Reward Lawyers

To discuss potential representation in a tax fraud whistleblower reward case with amounts in dispute in excess of $2 million, click here or contact the Director of our IRS whistleblower practice, Matthew Stock, at [email protected] or (202) 930-5901 for a free confidential consultation.

To discuss potential representation in a tax fraud whistleblower reward case with amounts in dispute in excess of $2 million, click here or contact the Director of our IRS whistleblower practice, Matthew Stock, at [email protected] or (202) 930-5901 for a free confidential consultation.

Matthew Stock, an attorney, Certified Public Accountant (CPA) and Certified Fraud Examiner (CFE), is routinely quoted in the media about whistleblower rewards programs. Recently, BNA interviewed Stock about IRS whistleblower rewards.

IRS Whistleblower Reward Program

The IRS estimates that the United States loses more than $688 billion per year to tax evasion. To combat tax fraud, Congress enacted legislation providing robust incentives for whistleblowers to report tax fraud. Under 26 USC § 7623(b), the IRS is required to issue an award to tax whistleblowers of 15% to 30% of proceeds collected from tax fraud or tax underpayments if:

- the whistleblower provides a tip that the IRS decides to take action on (a whistleblower cannot force the IRS to act on a tip);

- the amount in dispute (the tax underpayment, including interest and penalties) exceeds $2 million (if the taxpayer is an individual, his or her gross income must exceed $200,000 for at least one of the tax years in question); and

- the IRS collects tax underpayments resulting from the action (including any related actions).

In enacting the IRS whistleblower bounty legislation, Congress provided mandatory awards to tax whistleblowers for high-quality tips. Section 7623(b) suggests a focus on large-scale tax fraud in that Congress removed the previous cap of $10 million on IRS whistleblower awards. Thus, if a whistleblower meets the requirements above, the whistleblower may be able to receive a substantial payout.

On July 2, 2019, the Taxpayer First Act was signed into law. The law provides tax whistleblowers, among other things, significant protections against retaliation. Read more about the tax whistleblower protection law here.

IRS Whistleblower Reward Program’s Success

Since 2007, the IRS Whistleblower Office has issued more than $931 million in awards to tax whistleblowers based on the collection of $5.7 billion in proceeds. During FY 2018 and FY 2019, the IRS awarded more than $430 million to tax fraud whistleblowers, and whistleblowers enabled the IRS to recover more than $2 billion. See the FY 2018 report of the IRS Whistleblower Program and the FY 2019 report of the IRS Whistleblower Program.

Since 2007, the IRS Whistleblower Office has issued more than $931 million in awards to tax whistleblowers based on the collection of $5.7 billion in proceeds. During FY 2018 and FY 2019, the IRS awarded more than $430 million to tax fraud whistleblowers, and whistleblowers enabled the IRS to recover more than $2 billion. See the FY 2018 report of the IRS Whistleblower Program and the FY 2019 report of the IRS Whistleblower Program.

A denial of an award or reduction of up to 10% may be made in cases where the information provided to the IRS is:

- brought by an individual who “planned and initiated” the actions that led to the underpayment of tax.

- based on information derived from a judicial or administrative hearing; a governmental report, hearing, audit, or investigation; or the news media.

Tax whistleblower awards are subject to appeal to the U.S. Tax Court within 30 days of an IRS determination. For additional information on the process, click here.

If a tax whistleblower case does not meet the $2 million threshold (or cases involving individual taxpayers with gross income of less than $200,000), a whistleblower award may still pursue an award under section 7623(a). Under this section, the IRS may issue a discretionary award to a whistleblower for tips that lead to “detecting underpayments of tax, or bringing to trial and punishment persons guilty of violating the internal revenue laws or conniving at the same.” The awards under this program are a maximum of 15% of the proceeds collected, capped at $10 million. It should be stressed that awards under this program are discretionary, whereas awards under 7623(b) are mandatory.

IRS Whistleblower Awards Attorneys

Since the inception of the IRS Whistleblower Program, the IRS has issued more than $931 million in awards to whistleblowers. Since FY 2012, the IRS issued more than $841 million in awards:

- In FY 2019, the IRS issued 181 awards, totaling more than $102 million;

- In FY 2018, the IRS issued 217 awards, totaling more than $312 million;

- In FY 2017, the IRS issued 242 awards, totaling more than $33 million;

- In FY 2016, the IRS issued 418 awards, totaling more than $61 million;

- In FY 2015, the IRS issued 99 awards, totaling more than $103 million;

- In FY 2014, the IRS issued 101 awards, totaling more than $52 million dollars;

- In FY 2013, the IRS issued 122 awards, totaling more than $53 million dollars; and

- In FY 2012, the IRS made 128 awards, totaling more than $125 million dollars.

Notable successes of the IRS Whistleblower Program include:

- Bradley Birkenfeld was awarded $104 million after blowing the whistle on the Swiss Bank, UBS, for helping wealthy Americans hide their assets and evade taxes.

- An unidentified whistleblower received $38 million for exposing a corporate tax avoidance scheme.

- In Whistleblower 21276-13W v. CIR, two whistleblowers were issued an award for more than $17.5 million. Importantly, the Tax Court’s Final Order confirmed that when the IRS determines an award based on “collected proceeds,” this encompasses all dollars collected by the U.S. government, including criminal penalties, FBAR, etc.

- An unidentified accountant received $4.5 million after discovering a $20 million-plus tax liability at a Fortune 500 company. The accountant reported the liability and was subsequently ignored by the company.

- Wall Street insider nets a $2 million reward after exposing an alleged tax avoidance scheme by manufacturer Illinois Tools Works. This was the third seven-figure reward from the IRS for the anonymous whistleblower.

IRS Whistleblower Process

The IRS Whistleblower Office has recently released Publication 5251 – The Whistleblower Claim Process. The new publication provides general guidance on the tax whistleblower program and clarity on the types of information whistleblowers should provide to the office. In addition, the publication explores what happens to claims after the IRS receives them, communication with the IRS after a submission, and a process timeline for claims.

Eligibility for Tax Whistleblower Reward

Under the new tax whistleblower statute, the IRS is required to issue a reward to tax whistleblowers of between 15% and 30% of collected proceeds from tax fraud or tax underpayments if:

- the whistleblower provides specific and credible information that the IRS decides to take action on (a whistleblower cannot force the IRS to act on a tip);

- the information relates to tax underpayments of over $2 million (or if the subject of the claim is an individual, his or her gross income must exceed $200,000 for at least one of the tax years in question); and

- the IRS collects tax underpayments resulting from the action (including any related actions).

In the publication, the IRS outlines the types of “specific and credible” information that whistleblowers should provide when submitting a tip. This includes:

- A description of the amounts due, including a written narrative explaining the issue(s);

- Information to support the narrative;

- A description of the documents or supporting evidence not in the whistleblower’s possession or control; and

- An explanation of how the whistleblower obtained the information and if there is any relationship to the subject of the claim.

It is important for tax whistleblowers to provide the best information available as it may support the increase of a reward percentage (among other factors).

Submitting a Whistleblower Tip to the IRS

Once a whistleblower submits a tip, the Whistleblower Office will determine if it has merit, and then forward the tip to the appropriate operating division for further development. The publication notes this initial review generally takes 30-90 days and the Subject Matter Experts (SME) examination will take an additional 90 days. During the SME’s examination, the whistleblower may be contacted to make sure that the IRS fully understands the information submitted by the whistleblower.

Once a whistleblower submits a tip, the Whistleblower Office will determine if it has merit, and then forward the tip to the appropriate operating division for further development. The publication notes this initial review generally takes 30-90 days and the Subject Matter Experts (SME) examination will take an additional 90 days. During the SME’s examination, the whistleblower may be contacted to make sure that the IRS fully understands the information submitted by the whistleblower.

Thereafter, if the IRS does not pursue the claim, the agency will send the whistleblower a claim denial letter. Alternatively, if the IRS decides to pursue the claim, whistleblowers are able to receive updates from the IRS concerning the progress of the investigation. Under the Taxpayer’s First Act, which was enacted on July 1, 2019:

The Secretary shall disclose to an individual providing information relating to any purpose described in paragraph (1) or (2) of section 7623(a) the following:

(i) Not later than 60 days after a case for which the individual has provided information has been referred for an audit or examination, a notice with respect to such referral.

(ii) Not later than 60 days after a taxpayer with respect to whom the individual has provided information has made a payment of tax with respect to tax liability to which such information relates, a notice with respect to such payment.

(iii) Subject to such requirements and conditions as are prescribed by the Secretary, upon a written request by such individual—

(I) information on the status and stage of any investigation or action related to such information, and

(II) in the case of a determination of the amount of any award under section 7623(b), the reasons for such determination. Clause (iii) shall not apply to any information if the Secretary determines that disclosure of such information would seriously impair Federal tax administration. Information described in clauses (i), (ii), and (iii) may be disclosed to a designee of the individual providing such information in accordance with guidance provided by the Secretary.

Information About the IRS Whistleblower Program

Whistleblower protections for accountants and tax professionals bolstered by new law

Can tax whistleblowers remain anonymous?

Are whistleblowers protected against retaliation for disclosing tax fraud?

IRS Whistleblower Office Issues New Guidance on IRS Whistleblower Reward Process

IRS Whistleblower Office Calls on Congress to Protect Whistleblowers

Audit Reveals IRS Whistleblower Program Needs Improvements

IRS Whistleblower Program Paid More than $103M to Whistleblowers in FY2015

IRS Whistleblower Lawyers: Hire a Leading Whistleblower Law Firm

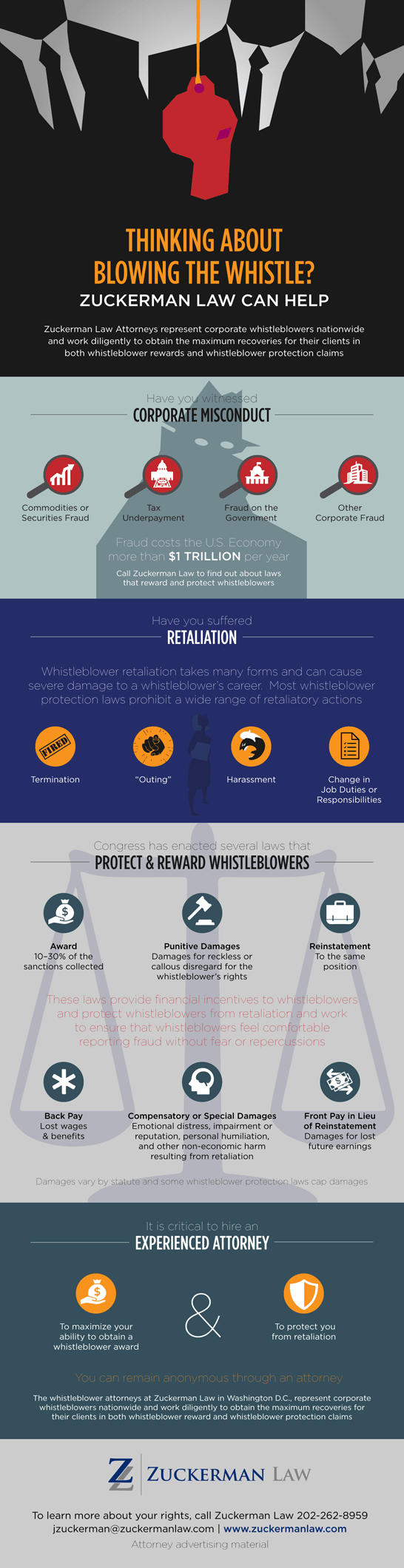

The whistleblower lawyers at Zuckerman Law have experience representing whistleblowers before the IRS and one of our attorneys is also a Certified Public Accountant and Certified Fraud Examiner. We are a leading whistleblower law firm and two of our attorneys were named top whistleblower lawyers in Washingtonian magazine.

U.S. News and Best Lawyers® have named Zuckerman Law a Tier 1 firm in Litigation – Labor and Employment in the Washington DC metropolitan area. Matthew Stock, the Director of the Whistleblower Rewards Practice at Zuckerman Law, has been quoted in leading publications about the IRS whistleblower program, including in Bloomberg BNA.

To discuss potential representation in a tax fraud whistleblower case with amounts in dispute of more than $2 million, click here or call us at (202) 930-5901.

What is the process to obtain an IRS whistleblower reward?

Recommended Posts

-

IRS Reports Increase in Whistleblower Awards The IRS Whistleblower Program's annual report for FY 2015…

-

Whistleblower Disclosed Complex Fraud Scheme The SEC announced a Dodd-Frank whistleblower award of more than…

-

Dos And Dont's For Lucrative SEC Whistleblower Tips A Law360 article titled Dos And Dont's…

-

Yesterday the SEC published for public comment its Draft Strategic Plan, which outlines the agency’s…

-

Whistleblower Outside U.S. Recovers Record SEC Whistleblower Award A Law360 article titled SEC Welcomes Foreign…

-

Leading SEC Whistleblower Lawyer Quoted About Award to Compliance Professionals An article in Law 360…