All too often, whistleblowers who disclose fraud to their employers, law enforcement, or government agencies suffer retaliation by their employers. Whistleblower retaliation takes a serious toll on whistleblowers both financially and emotionally, including an inability to pay living expenses, reputational harm, alienation, blacklisting, and emotional distress.

Whistleblower protection laws can provide a potent remedy, but before bringing a retaliation claim, it is crucial to assess the options under federal and state law and develop a strategy to achieve the optimal recovery. Key issues to consider include the scope of protected whistleblowing, the burden of proof, the damages that a prevailing whistleblower can recover, the forum where the claim would be litigated, and the impact of the retaliation claim on a whistleblower rewards claim.

Leading whistleblower firm Zuckerman Law represents whistleblowers nationwide. If you are seeking representation in a whistleblower retaliation or whistleblower protection case, click here, or call our whistleblower retaliation lawyers at 202-262-8959 to schedule a confidential consultation.

Scope of Protected Whistleblowing

- The False Claims Act (FCA) — protecting disclosures about fraud directed toward the government, including actions taken in furtherance of a qui tam action and efforts to stop a violation of the FCA;

- The Defense Contractor Whistleblower Protection Act (DCWPA) — protecting whistleblowing about gross mismanagement of a federal contract or grant; a gross waste of federal funds; an abuse of authority relating to a federal contract or grant or a substantial and specific danger to public health or safety, or a violation of law, rule, or regulation related to a federal contract;

- The Sarbanes-Oxley Act (SOX) — protecting disclosures about mail fraud, wire fraud, bank fraud, securities fraud, a violation of any SEC rule, or shareholder fraud;

- The Dodd-Frank Act (DFA) — protecting whistleblowing to the SEC about potential violations of federal securities laws;

- The Taxpayer First Act (TFA) — protecting disclosures about tax fraud or tax underpayment;

- The Consumer Financial Protection Act (CFPA) — protecting disclosures concerning violations of Consumer Financial Protection Bureau rules or federal laws regulating unfair, deceptive, or abusive practices in the provision of consumer financial products or services; and

- The Anti-Money Laundering Act (AMLA) — protecting disclosures about violations of the Bank Secrecy Act.

While most of these anti-retaliation laws protect internal disclosures (e.g., reporting to a supervisor), whistleblower protection under the DFA is predicated on a showing that the whistleblower disclosed a potential violation of federal securities law to the SEC prior to suffering an adverse action.

State law may also provide a remedy, including the anti-retaliation provisions in state FCAs. And approximately 42 states recognize a common law wrongful discharge tort action (a public policy exception to at-will employment), which generally protects refusal to engage in illegal activity and the exercise of a statutory right.

Burden of Proof

Damages and Remedies in Whistleblower Retaliation Cases

While a prevailing whistleblower can recover back pay under both the DFA and SOX (double back pay under the former and single back pay under the latter), the DFA does not authorize special damages, i.e., damages for emotional distress and reputational harm. In contrast, SOX authorizes uncapped compensatory damages. Therefore, a whistleblower protected under both statutes should bring the SOX claim within the much shorter SOX statute of limitations (180 days) to recover both double back pay and special damages.

State law may also provide a remedy, and if the whistleblower can pursue both a statutory remedy and a wrongful discharge tort, the latter may offer the opportunity to seek punitive damages.

Forum Selection and Administrative Exhaustion

Several of the corporate whistleblower protection laws require that the whistleblower file the claim initially at a federal agency and permit the agency to investigate the claim before the whistleblower can litigate the claim. This is called administrative exhaustion, and failure to comply with that requirement can waive the claim. In contrast, the FCA and DFA do not require administrative exhaustion.

Impact of Whistleblower Retaliation Claim on Whistleblower Rewards Claim

Another important consideration is the potential impact of a retaliation case on a qui tam or whistleblower rewards case. Filing an FCA retaliation claim while a qui tam suit is under seal poses some risk of violating the seal, which could bar the whistleblower from recovering a relator share. Therefore, counsel should consider filing the FCA retaliation claim under seal along with the qui tam suit.

Although the patchwork of whistleblower protection laws fails to protect disclosures about certain forms of fraud, there are important pockets of protection. To effectively combat retaliation, whistleblowers should avail themselves of all appropriate remedies.

Whistleblower Protections for False Claims Act Whistleblowers

Whistleblower Protections for SEC Whistleblowers

IRS Tax Fraud Whistleblower Protection

Whistleblower Retaliation Damages and Remedies

Whistleblower Retaliation Lawyers

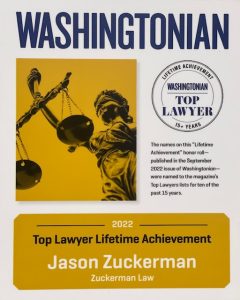

In 2019, the National Law Review awarded Jason Zuckerman its “Go-To Thought Leadership Award” for his analysis of developments in whistleblower law. We represent whistleblowers nationwide.

Click here to read reviews of our whistleblower retaliation lawyers from clients that we have represented in whistleblower rewards and whistleblower retaliation matters.