Financial Incentives for Disclosing Sanctions Evasion

Under the whistleblower provisions of the Anti-Money Laundering Act (AMLA), a whistleblower who voluntarily reports original information about U.S. sanctions evasion that leads to a judicial or administrative action imposing penalties exceeding $1,000,000 can obtain an award of 10% to 30% of the collected monetary sanctions. To qualify for a whistleblower award under the AMLA, a whistleblower must provide original information to their employer, the U.S. Department of Treasury (Treasury), or the U.S. Department of Justice (DOJ). If represented by counsel, a whistleblower can submit information anonymously. Whistleblowers abroad who are not U.S. citizens are eligible for AMLA whistleblower awards.

Under the whistleblower provisions of the Anti-Money Laundering Act (AMLA), a whistleblower who voluntarily reports original information about U.S. sanctions evasion that leads to a judicial or administrative action imposing penalties exceeding $1,000,000 can obtain an award of 10% to 30% of the collected monetary sanctions. To qualify for a whistleblower award under the AMLA, a whistleblower must provide original information to their employer, the U.S. Department of Treasury (Treasury), or the U.S. Department of Justice (DOJ). If represented by counsel, a whistleblower can submit information anonymously. Whistleblowers abroad who are not U.S. citizens are eligible for AMLA whistleblower awards.

The Treasury can bring civil enforcement actions against persons who violate U.S. sanctions and can impose significant monetary penalties. For example, in 2023, the Treasury’s Office of Foreign Assets Control (OFAC) brought civil enforcement actions resulting in more than $1.5 billion in penalties and settlements. The “U.S. persons” required to comply with U.S. sanctions includes “any United States citizen, permanent resident alien, entity organized under the laws of the United States or any jurisdiction within the United States (including foreign branches), or any person in the United States.” 31 CFR § 560.314. Non-U.S. persons are also subject to certain OFAC prohibitions. For example, non-U.S. persons are prohibited from causing or conspiring to cause U.S. persons to wittingly or unwittingly violate U.S. sanctions, as well as engaging in conduct that circumvents U.S. sanctions.

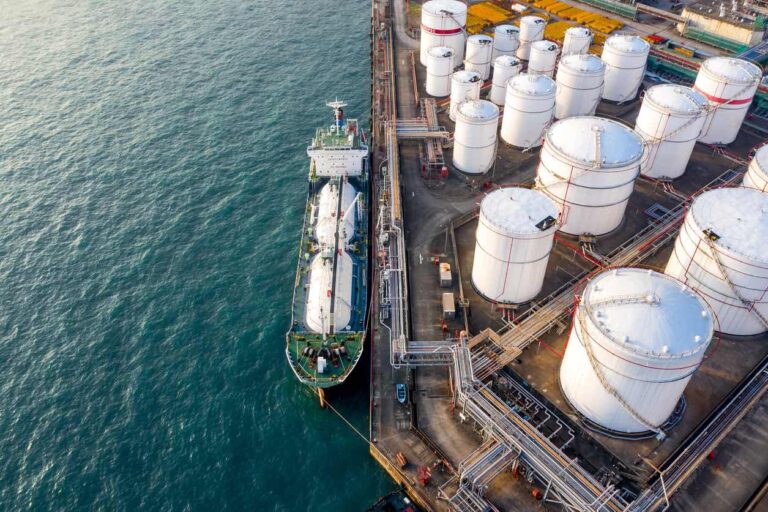

“Dark Vessels” Concealing Sanctions Violations

To conceal sanctions evasion, ships are faking their locations by switching off their location transponders, otherwise known as automatic identification system (AIS) “spoofing.” According to a CNBC article about dark ships faking their locations to move oil around the world, data from maritime technology company Windward revealed a 12% increase in location manipulation among oil tankers and ships carrying dry cargo for the first half of 2023 compared to 2022, and an 82% increase over the first half of 2021. The data suggests that AIS spoofing has become common practice. As revenue generated by the illegal sale of Iranian petroleum products funds malign activities, including support for terrorism, the DOJ is prioritizing enforcement of U.S. sanctions in the shipping industry, including schemes designed to disguise the true origins of cargo.

For example, in September 2023, the DOJ announced that it disrupted a multimillion-dollar shipment of crude oil by the Islamic Revolutionary Guard Corps (IRGC) that was bound for another country. The DOJ alleges that the scheme involved multiple entities affiliated with Iran’s IRGC and the IRGC-Qods Force “to covertly sell and transport Iranian oil to a customer abroad” and that “[p]articipants in the scheme attempted to disguise the origin of the oil using ship-to-ship transfers, false automatic identification system reporting, falsified documents and other means.” Suez Rajan Limited pleaded guilty to conspiring to violate the International Emergency Economic Powers Act (IEEPA) by facilitating the illicit sale and transport of Iranian oil and was sentenced to three years of corporate probation and a fine of almost $2.5 million. The 980,000 barrels of contraband crude oil that the U.S. seized is now the subject of a civil forfeiture action.

Detecting Sanctions Violations in the Maritime and Transportation Industries

On December 11, 2023, federal agencies that enforce U.S. sanctions issued a joint compliance note titled Know Your Cargo: Reinforcing Best Practices to Ensure the Safe and Compliant Transport of Goods in Maritime and Other Forms of Transportation, which identifies common tactics deployed by malign actors in the maritime and other transportation industries – including transportation companies, maintenance companies, insurance providers, other financial institutions, and other entities involved in funding and facilitating the transport of cargo. Such techniques include:

- “Manipulating location or identification data: Obfuscating the location, origin, or destination of a carrier is a common means of evading legal restrictions . . . Vessels engaged in illicit trade often disable their AIS devices to mask their location and movement or manipulate their AIS data to broadcast a false location. This is often done in conjunction with the manipulation of identifiers, such as International Maritime Organization (IMO) numbers.

- Falsifying cargo and vessel documents: Those attempting to disguise the origin or destination of their cargo may utilize falsified shipping documents, including, but not limited to, bills of lading, certificates of origin, invoices, packing lists, proof of insurance, and lists of last ports of call.

- Ship-to-ship transfers: Although often conducted for legitimate purposes, ship-to-ship transfers are also a tactic used in illicit maritime trade to try to conceal the origin or destination of cargo. Transfers that occur at night or in geographical areas determined to be high-risk for illicit activity are of particular concern.

- Voyage irregularities and use of abnormal shipping routes: Persons involved in illicit trade may try to disguise the destination or origin of cargo or its recipients by using indirect routing, unscheduled detours, or transit or transshipment through third countries. Such suspicious deviations in route—changes that are made without what appears to be a legitimate reason to go off-route, such as unsafe ports, extreme weather, or emergencies—may signal unlawful conduct.

- Frequent registration changes: In an effort to evade certain management measures or national provisions, those engaging in illicit maritime trade may participate in “flag hopping,” which involves the repeated re-registration of the vessel under new states’ flags.

- Complex ownership or management: Illicit actors take advantage of the inherent complexity of the maritime and other transportation industries by using shell companies or opaque ownership and management structures to disguise the ultimate beneficial owner of cargo, the end user, or other entities involved in the shipment process. Obscure ownership structures or frequent changes in ownership or management of companies may be a sign of illicit activity.”

If you have original information about U.S. sanctions evasion, contact an experienced whistleblower attorney to find out how to qualify for an AMLA whistleblower award.

Sanctions Evasion OFAC Whistleblower Program

Guide to Anti-Money Laundering Act Whistleblower Rewards and ProtectionsHow Can a Sanctions Evasion Whistleblower Lawyer Help a Whistleblower Maximize their Recovery?

The sanctions evasion whistleblower lawyers at Zuckerman Law have experience representing sanctions evasion whistleblowers and one of our attorneys is also a Certified Public Accountant and Certified Fraud Examiner. Our multi-disciplinary whistleblower rewards practice is staffed with an attorney who is also a Certified Public Accountant and Certified Fraud Examiner with substantial experience investigating complex financial frauds.

Our team of AML whistleblower lawyers can:

- Enable a whistleblower to report anonymously.

- Help a whistleblower qualify for an award under other whistleblower reward programs, such as the IRS whistleblower reward program or the SEC whistleblower reward program.

- Skillfully guide a whistleblower through the process, maximizing the likelihood that they will qualify for an award.

- Assist the whistleblower to combat workplace retaliation.

Contact us today to find out how we can help you report AML or sanctions violations while remaining anonymous.